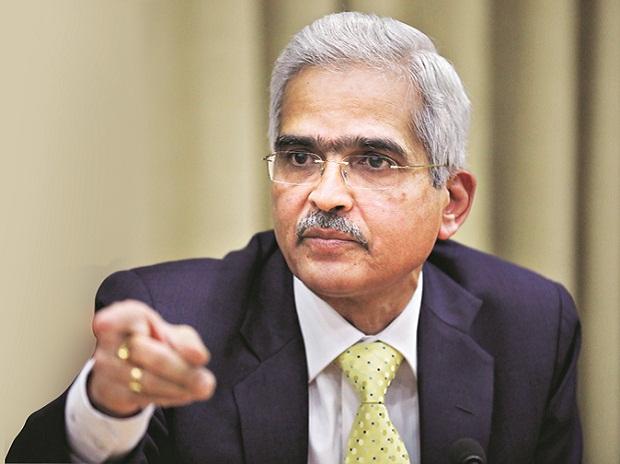

Covid-19 relief: RBI cuts repo 75 bps; defers term-loan EMIs for 3 months

The Reserve Bank of India (RBI) on Friday

went all guns blazing to arrest a potential slowdown caused by the coronavirus

(Covid-19), lowering the policy repo rate by 75 basis points to 4.4 per cent.

"Given the Covid-19 stress, the

six-member monetary policy committee (MPC) advanced their March 31-April 3

meetings to meet on March 24-26 and 27, and voted 4:2 to cut the policy repo

rate to 4.4 per cent", Reserve Bank of India Governor Shaktikanta Das, who

addressed the media through video streaming, said.

At the same time, the reverse repo

rate, which is the rate at which banks keep their excess funds with the RBI,

was lowered by 90 basis points to discourage banks from keeping their excess

liquidity with the central bank. The idea is that banks must lend funds for

productive needs.

Apart from the rate cuts, the central

bank also announced a number of liquidity infusion measures, putting Rs 3.74

trillion of liquidity in the banking system. The total liquidity infusion by

the central bank due to coronavirus stress now amounts to an unprecedented Rs

6.5 trillion.

Comments

Post a Comment